wichita ks sales tax rate 2019

Divide Line 15 by Line 23 and multiply by 10018 0706083100 25. Retail Sales Associate salaries in Wichita KS can vary between 16500 to 40000 and depend on various factors including.

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Wichita County Tax Office.

. Vehicle Property Tax Estimator. 3 lower than the maximum sales tax in KS. The Kansas use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Kansas from a state with a lower sales tax rate.

Rehabilitation of the Kechi Playhouse. Tax Code Section 2601213. The total is the 2019 county effective tax rate19 1Tex.

Subscribe to our Newsletter Submit. In 2019 it was 32721 based on the Sedgwick County Clerk. Sales Tax State Local Sales Tax on Food.

This 2019 Ford Ranger in WICHITA KS is available for a test drive today. Thats an increase of 1431 mills or 457 percent since 1994. The current 65 food tax is among the highest in the nation especially when coupled with local sales taxes.

In Wichita the rate is six percent. Sales Tax State Local Sales Tax on Food. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Kansas sales tax changes effective July 1 2019. For tax rates in other cities see Kansas sales taxes by city and county. The Kansas sales tax rate is currently.

2019 effective tax rate. Sales Taxes Amount Rate Wichita KS. New sales and use tax rates take effect in the following cities counties and special jurisdictions on July 1 2019.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. State Income Taxes. Sales Tax Rate Down Payment Loan Term years Interest Rate Total Price.

There is no applicable city tax or special tax. With local taxes the total. Real property tax on median home.

Tax Code Section 2601214 9Tex. This is the total of state county and city sales tax rates. Arts Business District.

Including local taxes the Kansas use tax can be as high as 3500. Real property tax on median home. The County sales tax rate is.

Total of Term Payments. State Sales Tax. The tax is collected as a percentage of total room revenue not the number of rooms or the rate charged for rooms.

Add together the effective tax rates for each type of tax the county levies. Wichita KS 67218 Email Sedgwick County Tag Office. On March 26 2019 the Kansas Senate confirmed Mark Burghart as the Secretary of Revenue.

No City Sales Tax. No Local Income Tax. Resident will owe Kansas use tax of 895 current Anytown rate on the total charge of 2000 when that resident brings the laptop computer back to Anytown KS.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. The Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. 39730600 in vehicle title transactions915599315 in motor vehicle registrations and another 1704321344 in sales tax.

Come to Eddys Cadillac to drive or buy this Ford Ranger. The average salary for a Retail Sales Associate in Wichita KS is 22500 per year. The bill incrementally reduces the state sales tax rate on food.

View City Fee Resolution PDF to see established fees and charges effective October 2019. Kansas has state sales tax of 65. 31 rows The state sales tax rate in Kansas is 6500.

With the over 65 and or. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. The rates listed below include the state sales tax rate of 65.

Average Sales Tax With Local. These are for taxes levied by the City of Wichita only and do not include any overlapping jurisdictions Wichita mill levy rates. Wichita City Council is raising the sales tax from 75 to 95 - a 27 increase - in a community improvement district near the new baseball stadium and on the east bank of the Arkansas River.

You can print a 75 sales tax table here. The minimum combined 2022 sales tax rate for Wichita Kansas is. BFR CPA LLC is one of the leading tax and accounting firms in Wichita Kansas and the surrounding area.

Exemptions on your property for 2019 are shown on your tax statement. The Wichita sales tax rate is. The Kansas use tax rate is 65 the same as the regular Kansas sales tax.

940 766 Main number. SALES TAX WH TAX INCOME RESPONSIBLE PARTY TAX TYPE. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax.

While the Kansas Department of Revenue collects the tax the proceeds are returned to the cities or counties except for a two percent processing fee. The combination of our expertise experience and the team mentality of our staff assures that you will receive the close analysis. - Single standard deduction one exemption - Sales Tax includes food and services where.

These insights are exclusive to Mint Salary and are based on 89 tax returns from TurboTax customers who reported this type of occupation.

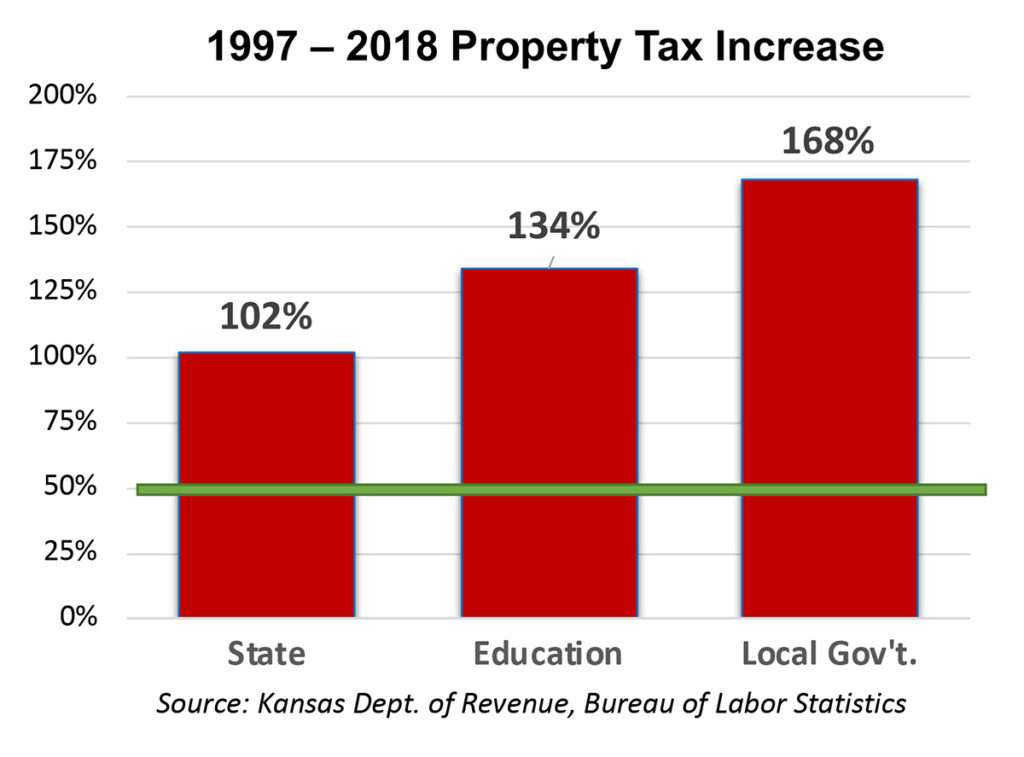

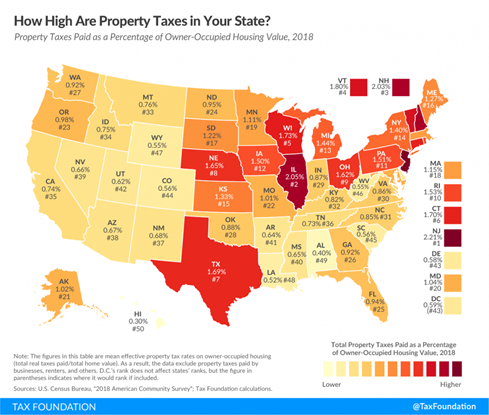

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Wichita Property Tax Rate Up Just A Little

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

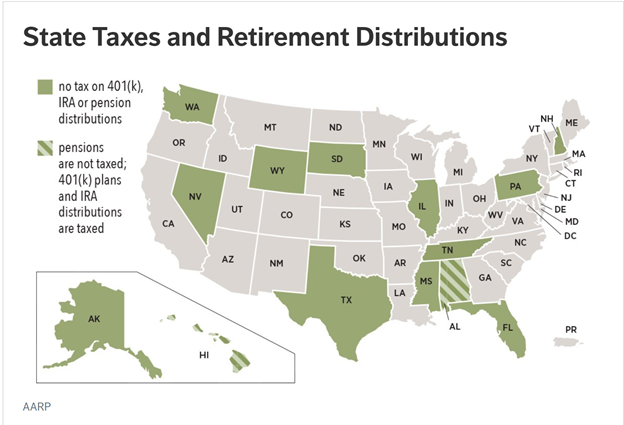

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Kansas Sales Tax Guide And Calculator 2022 Taxjar

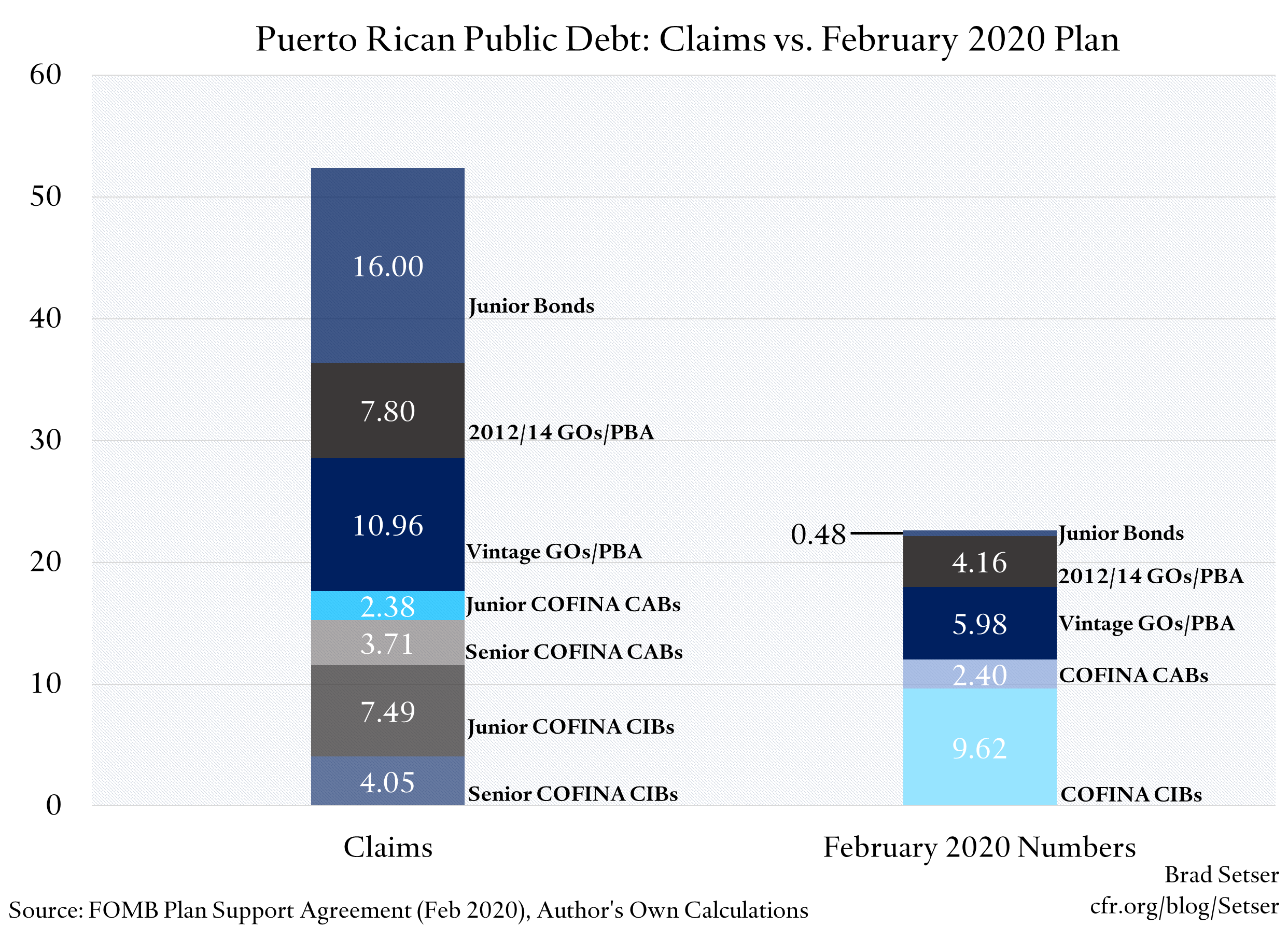

What Exactly Is In The New Agreement Between Puerto Rico S Board And Its Creditors Council On Foreign Relations

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

File Sales Tax By County Webp Wikimedia Commons

Kansas Income Tax Calculator Smartasset

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Sales Tax On Cars And Vehicles In Kansas

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute